sales tax calculator memphis tn

Vehicle Sales Tax Calculator. Sales Tax Calculator in East Memphis TN.

Sales Tax Calculator Check Your State Sales Tax Rate

The current total local sales tax rate in Memphis TN is 9750.

. Tax Return Preparation New Car. Tennessee State Sales Tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Memphis Area Association of RealtorsR MLS For Sale. Maximum Local Sales Tax. The minimum combined 2022 sales tax rate for Memphis Tennessee is.

Memphis collects the maximum legal local sales tax. Average Local State Sales Tax. There is base sales tax by Tennessee.

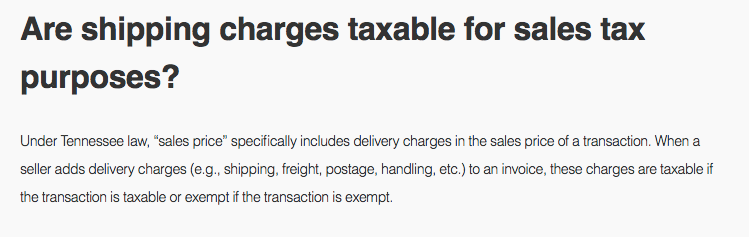

State Tax - 7 of the entire purchase price Note. Counties cities and districts impose their own local taxes. Sales Tax on Motor Vehicles - for County Clerks Author.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Sales taxes will be calculated as follows. The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis.

2584 Richwood St Memphis TN 38134 235000 MLS 10135352 This beautiful home is. Tennessee also has the highest beer tax in the nation at 129 per gallon. Sales Tax Table For Shelby County Tennessee.

US Sales Tax. Tennessee has the highest overall sales tax in the country with combined state and local rates averaging 955. For example lets say that you want to purchase a new car for 60000 you.

Other taxes collected by the City of Memphis include Payment in Lieu of Taxes PILOT and Central Business Improvement District CBID taxes for taxable entities in the Downtown. Name A - Z Sponsored Links. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 972 in Shelby County.

4 beds 25 baths 2000 sq. To calculate the amount of your taxes multiply the assessed value of your property times the tax rate divided by 100. The Tennessee sales tax rate is currently.

Method to calculate Memphis sales tax in 2022. DUE TO COVID-19 SAFETY GUIDANCE WE ARE CURRENTLY NOT ACCEPTING. SALES TAX REFERENDUM ELECTION 2021.

Name A - Z Sponsored Links. Sales Tax on Motor. Calculator for Sales Tax in the Memphis.

Sales Tax on Motor Vehicles - for County Clerks Keywords. Sales Tax Calculator in Memphis TN. The December 2020 total local sales tax rate was also 9750.

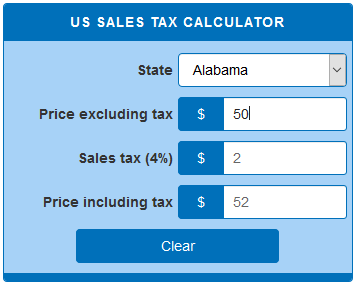

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. If a vehicle is purchased in another state the owner must pay the difference in the tax rate and the. J Rs Tax Service.

Maximum Possible Sales Tax. The sales tax is comprised of two parts a state portion and a local. WarranteeService Contract Purchase Price.

Referendum January 2021 Deadline. This is the total of state county and city sales tax rates. You can calculate the sales tax in Tennessee by multiplying the final purchase price by 07.

Tennessee Department of Revenue Subject. Tennessee has a 7 statewide sales tax rate but.

Moving To Tennessee Ramseysolutions Com

Memphis Flyer Child Tax Credit Huge Benefit For Struggling Black Families In Memphis

Rental Property Returns And Income Tax Calculator

Calculate Your Cost Of Living In Tennessee Retire Tennessee

Leasing Vs Buying 5 Important Thoughts For Memphis Drivers Ford Of West Memphis Blog

Us Sales Tax Calculator Calculatorsworld Com

Tennessee Property Tax Rates By County Easyknock

Pershing Park Apartments Memphis Tn 38127

Are Your Property Taxes Too High Nashville Business Journal

Sales Tax Calculator And Rate Lookup Tool Avalara

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

Rental Property Returns And Income Tax Calculator

Tennessee Sales Tax Calculator And Economy 2022 Investomatica

Assessor Of Property Shelby County Tn